Australia’s construction sector is being crushed by a surge in late payments, with a staggering nine-in-ten tradies reporting overdue invoices over the last 12 months.

The freshly released data underscores a crisis hitting the entire industry’s cash flow, affecting profitability and even putting some construction businesses at risk of closure in a worrying trend for the nation’s builders and tradies.

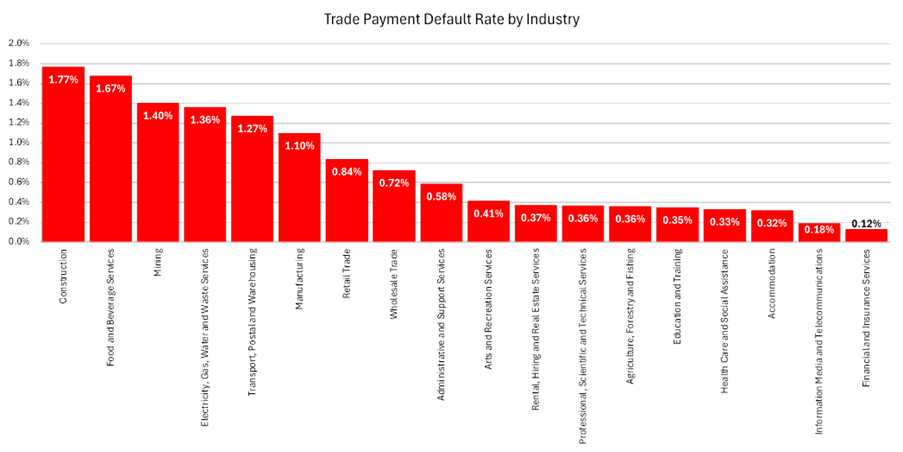

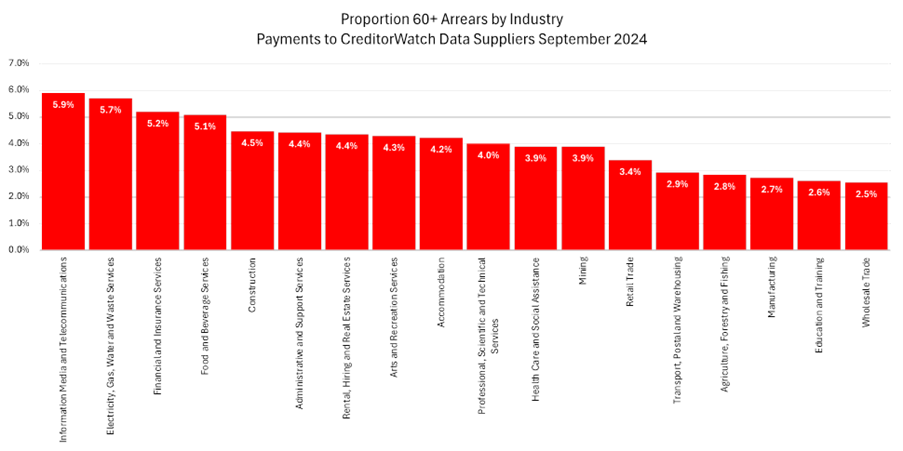

The findings by credit reporting agency CreditorWatch reveal that the construction industry is experiencing the highest levels of late payments of any industry nationwide.

92 per cent of construction firms say they have had overdue invoices in the last 12 months, with 39 per cent being overdue by more than 30 days at a time.

While these overdue payments are hurting firms of all sizes, it’s the ‘one-man band’ sole traders, and smaller firms said to be feeling the brunt of the pain, as they lack the financial resilience and cash flow resources of larger organisations to chase late payments.

CreditorWatch CEO Patrick Coghlan says the trend significantly impacted the firm’s profitability, with some forced to close shop due to subsequent cashflow constraints.

“Late payments are more than an inconvenience; they’ve become a critical issue for businesses, affecting cash flow, operational stability, and even their long-term survival,” he told Build-it.

“This is placing enormous pressure on companies, particularly small and medium-sized enterprises, which often lack the financial buffers, negotiating power, and collections capabilities that larger corporations have.”

Queensland-based Care-tech Plumbing and Gas manager Annette Baker told Build-it she had experienced some invoices go unpaid for up to a year before they could be settled.

“Most of our clients are pretty good, but you do get the odd one that will let invoices go unpaid, so it’s important to stay on top of it,” she explained.

“We’ve learnt the longer you leave it, the harder it becomes to recoup payment in the long run; some clients will then try to wriggle their way out of payment, saying the bill has been paid already or they have no record of the work being complete.”

Cashflow constraints leading to business collapse

These late payments are having a devastating ripple effect on construction firms’ ability to settle their own bills.

CreditorWatch’s August Business Risk Index highlighted that business payment defaults have also risen by 68.1 per cent over the past year, indicating that cash flow issues are beginning to seriously affect businesses.

The data revealed that a firm with just one payment default has a 28 per cent chance of shutting down within 12 months, while those with four or more face a 74 per cent closure rate.

These figures indicate a cash flow constraint and a systemic issue that businesses across these sectors are grappling with – that late payments represent an existential threat, especially in a sole trader-heavy industry where many businesses lack the leverage to demand payment in the same way larger corporations might.

Late payment fightback

To help Build-it readers combat the cash flow crunch caused by late payments, we asked CreditorWatch for their best strategies to ensure you get paid on time.

These strategies can provide crucial respite for smaller businesses that are often reliant on timely payments to keep operations running smoothly. For construction businesses, implementing these strategies may be the difference between staying operational and facing closure in an industry where timely cash flow is essential.

According to CreditorWatch’s Business Sentiment Survey, the most popular approaches used by construction firms include avoiding clients with a history of late payments (39 per cent), requiring some payment in advance (35 per cent), and imposing penalties for overdue payments (28 per cent).

Meanwhile, a significant portion of smaller companies (25 per cent) opt for shorter payment terms to encourage quicker cash flow.

Annette told Build-it she had found several tools that were successful in ensuring slower clients pay their overdue invoices.

“Normally, a reminder email and the warning of a potential late payment charge are enough for most to fix the bill,” she explained.

“But if a client has a repeated history of not paying their invoices in an acceptable time frame, I would suggest getting a payment in advance, especially for those bigger jobs that have a lot of outlay.”