Homeowners are repaying almost three times the amount of their original home loan due to rising interest rates and admin costs, new research has shown.

Data collected by finance information platform MNY found mortgage holders could be overpaying 2.8 times their original borrowed amount.

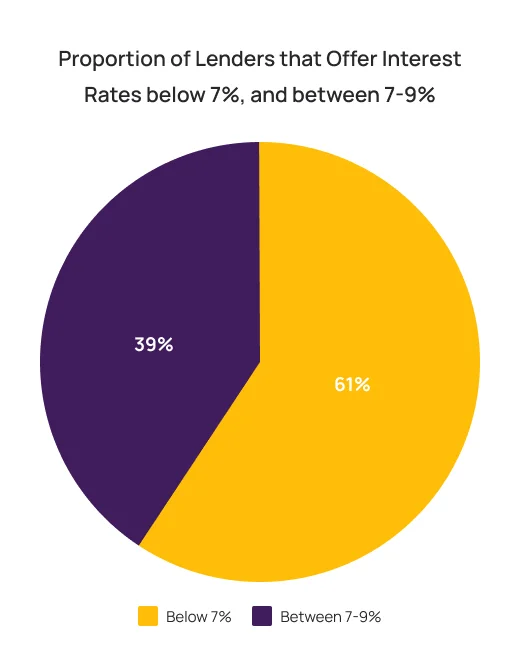

Significant discrepancies in comparable loan products show some variable rates currently differ up to 2.81 per cent between lenders, which rises to 2.95 per cent once admin costs are factored in.

That’s a jump of $1148 in monthly repayments for the average mortgage holder.

MNY analysed variable home loan products across 23 lenders, looking at base and comparison interest rates, monthly repayments, upfront, ongoing and exit fees, maximum loan-to-value ratio, and lender’s mortgage insurance.

The highest interest rate found by MNY was 8.94 per cent, meaning an Aussie homeowner with an average mortgage of $600,000 would repay $1,706,993 – a whopping $1,106,993 in interest alone.

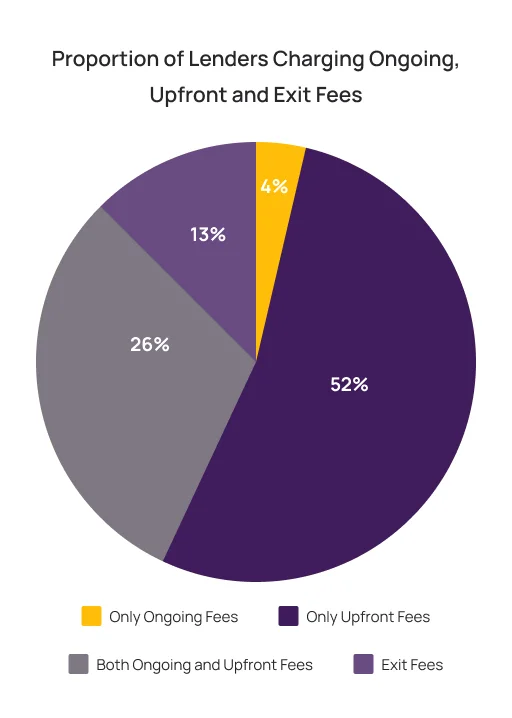

Over half of all lenders charge upfront fees as high as $1195 to take out the loan, while nearly a third charge annual administration fees up to $491.

Research key to home loan savings

The findings come amid Australia’s ongoing housing crisis, with rising interest rates and housing affordability at the forefront of Australia’s current political agenda.

The federal government has set itself the ambitious task of building 1.2 million new homes by the end of the decade in a bid to ease housing pressures; however, building approvals still need to catch up.

Meanwhile, most financial experts are also forecasting the RBA to slash interest rates by either the end of 2024 or the start of next year, in a welcome relief to those homeowners struggling to pay back their mortgage.

However, with no guarantee rates will come down, MNY Business Analyst Sabina Khanusiak told Build-it that those looking to take out a loan or refinance are best focusing on what they can control – doing their own research.

“There have been 13 interest rate rises in the past two years, which puts an enormous strain on mortgage holders. There is no guarantee when that will stop,” she said.

“Buying a home is the biggest financial commitment most people will make and the interest rates and associated fees can make all the difference to how much mortgage holders will ultimately repay and whether those repayments are sustainable over the life of the loan.”

According to MNY’s research, even the loan products with the lowest interest rates and fees available will have households repaying double the amount they originally borrowed.

Savina says understanding the types of loans available and the fine print of those products can help home buyers minimise excess mortgage expenses.

“Navigating home loan products and understanding the disadvantages and benefits of each can be daunting, but it is worth the effort in the long term. It could mean the difference between repaying your loan three times over, or twice. That is a significant difference on a $600,000 loan.”